How Happy Investors Grow Your PM Revenue

Most managers don’t lose business because they’re bad at operations. They lose it because investors can’t see the value of those operations. When the only time an owner hears from you is when something breaks, it’s easy for them to assume the property is a headache and the manager is a cost.

Flip that perception and the economics of your business change.

Retention Is the Quiet Multiplier

Every investor you keep is lifetime revenue you don’t have to replace. Retention also fuels:

- Referrals: Satisfied owners talk. Their peers trust them more than ads.

Expansion: Owners with confidence buy more doors—and often want you to manage them. - Stability: Predictable revenue lets you hire smart and invest in your team.

The lever behind all three? Clarity. When investors see cash flow, principal pay-down, equity growth, and tax advantages in one simple narrative, they stay calm during bumps and stay loyal over years.

What Investors Actually Want

Most owners aren’t obsessed with maintenance tickets. They’re busy. They want to know one thing: Is my portfolio quietly building wealth while I live my life? Answer that well, and you earn permission to guide decisions:

- Repositioning a unit for stronger rent.

- Timing a refi to unlock equity without kneecapping cash flow.

- Adding a door when the numbers support it.

Your Playbook: Turn Reporting Into Retention

- Lead with wins, not incidents. Start updates with progress (equity, principal reduction) before costs.

- Compare like an advisor. Show performance by property and against simple benchmarks so owners see where to act.

- Translate data into moves. Every report ends with “Here’s what we recommend next and why.”

- Systemize touchpoints. A reliable monthly pulse + quarterly review beats sporadic, reactive calls.

What This Does for Your Bottom Line

- Lower churn: Fewer owner exits mean steadier revenue.

- Higher LTV: Owners who expand portfolios increase fee volume without additional acquisition cost.

- Cheaper growth: Referrals reduce marketing spend and sales cycles.

None of this requires reinventing your business. You’re already doing the work; you just need a clearer way to present it so owners feel confident and stick around.

The Future of Property Management Belongs to Strategic Managers

Investors may own the property, but you own the relationship. And relationships are what keep portfolios — and businesses — growing.

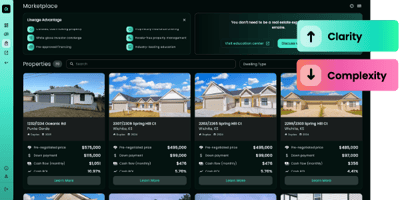

With Lineage, you finally have a tool that proves your worth, strengthens your partnerships, and brings clarity to an industry that desperately needs it.

Stop being seen as the rent collector. Start being recognized as the asset manager you already are.

Ready to bridge the gap with your investors?